Epicenter Trium

EPIC/ECR/EUSD Quick Overview

EPIC

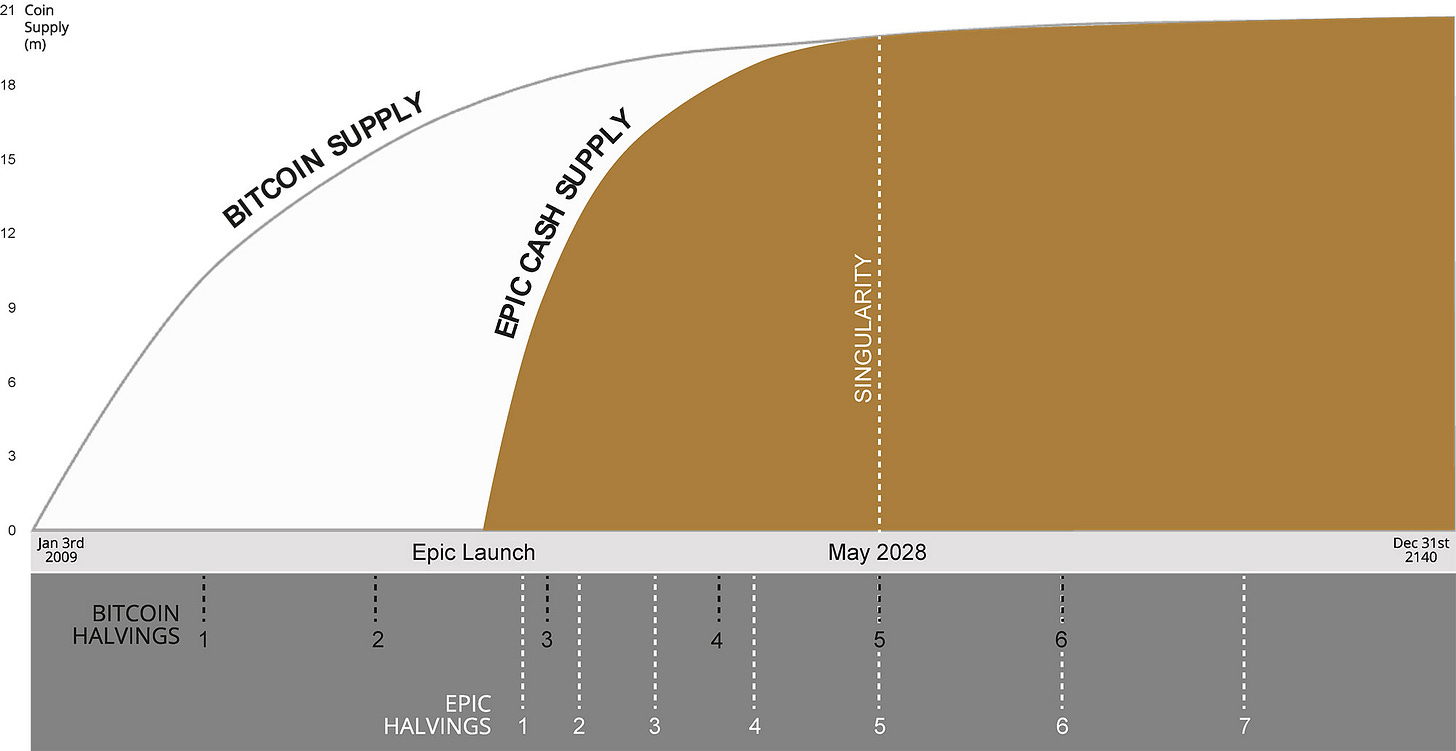

We consider it to be Bitcoin Perfected, how Satoshi would obviously have done it had he started in 2019 instead of 2009. It is the Bitcoin monetary emission standard of 21 million in the year 2140. Using Nakamoto Consensus and proof of work, its crucially important original game theory is preserved intact.

While 100% of the code is freshly-written & independently audited Rust vs. original Satoshi C++ that most lazy forks use, only 2% of the spiritual DNA is tweaked, and that 2% is, as we know, the difference between a Chimpanzee and a Homo Sapiens Sapiens.

The Achilles heel of BTC is its lack of fungibility. No fungibility means it has the ineradicable problem of tainted coins and a differential market for freshly mined coins and those that have circulated. It burdens everyone with costs, adds friction and risks, and presents an attack surface / control vector for governments to apply AML regulation. El Salvador is a great example - without KYC, people are frozen out of the system and marginalized. BTC officially has no answer for the 1.7 billion as yet unbanked.

EPIC can be thought of as “https://bitcoin”, because everything is confidential to external parties by default - no addresses and no amounts are publicly revealed, and every transaction in a block is one giant CoinJoin, meaning you can’t unscramble the egg ex post facto. A form of blockchain compression known as Mimblewimble nets out offsetting transactions, so it’s also very light, fast, and lean - perfect for mobile devices - <2gb at present vs 355gb for BTC. Even at BTC-level usage, it will still only be 25-50gb.

Will governments and 3 letter agencies have a problem with this tech? No, because it is a “goldilocks level” that precludes frontrunning and AI-driven social credit style transaction filtering, it is not aimed at facilitating crime. The crude approaches to privacy pursued by earlier networks are overkill and arouse the ire of powers that be, provoking an immune response.

Though cryptocurrency adoption has made great strides, volatility is still a major unsolved problem, and two facts point to the central relevance of stablecoins as key infrastructure for not just BTC but the entire space: 1) 90+% of trading activity is in the BTC/USDT pair and 2) Growth from $2b to $100+b in 3 years of the stablecoin market cap. EPIC has original Number Go Up ™ Technology, designed to drive price to infinity through disinflationary halvings just like its earlier BTC forebear. However, this powerful and very desirable feature is actually a bug for people who would want to denominate their affairs (imagine a long term contract) in this currency - someone is going to get a bad deal.

One Coin - Two Sides - Three Functions (Store of Value, Medium of Exchange, Unit of Account)

EUSD

Clearly, what is needed is a type of asset that will stay around $1 in value, but not have any connection at all to anything that any government can attack, seeing as how USDC just got a SEC subpoena. For this, we creatively reference EPIC in a pre-1971 dollar-inspired cryptodollar design known as EUSD. Censorship resistance is paramount, and regulatory compatibility is a huge part of that.

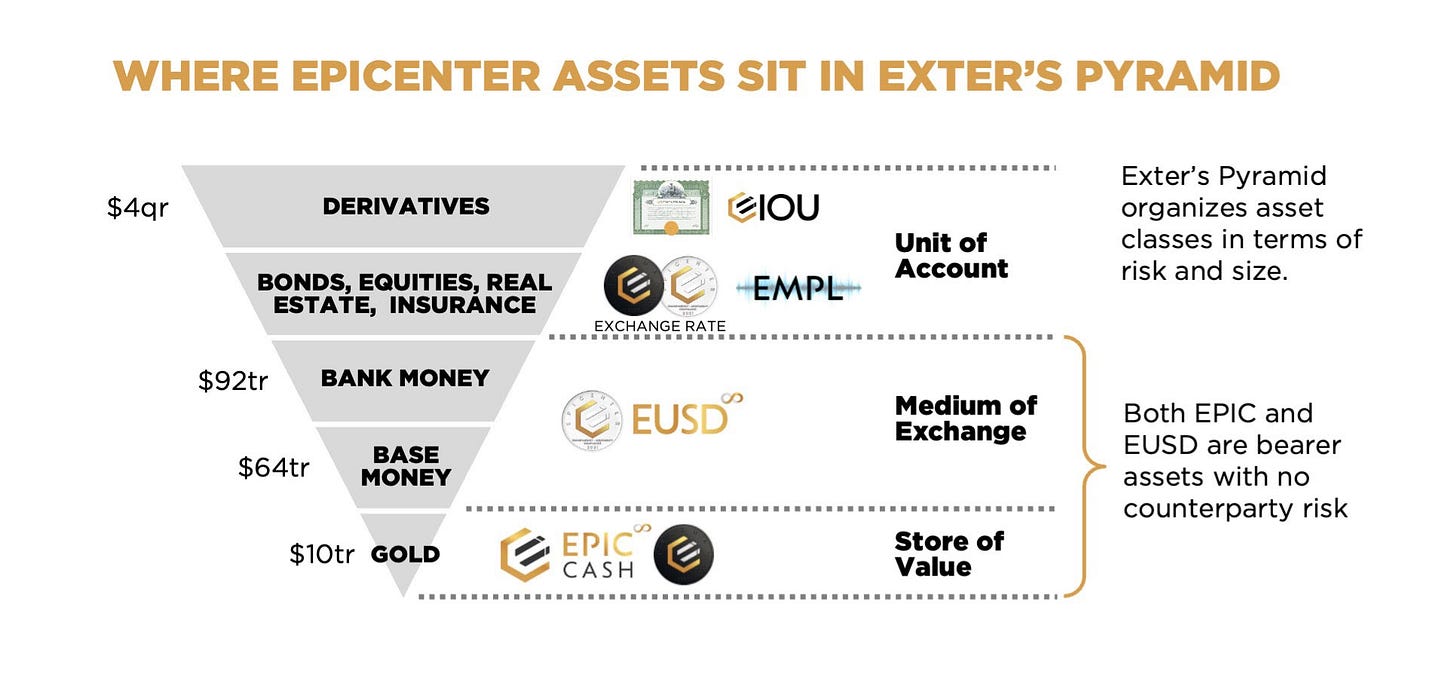

EPIC plays the role of gold in our Exter’s Pyramid, as it is the collateral underlying the EUSD token. EUSD is, like the pre-1971, Federal Reserve Note, redeemable on demand for real money - in the case of Federal Reserve Note, 1/35th oz of physical gold, only open to central banks, and only if the government allowed it. With EUSD, it’s $1 worth of EPIC zapped directly to the user’s wallet via anonymous smart contract, 24/7, anyone, anytime, and nobody can ever be denied service. A cryptodollar (aka stablecoin) is, like its namesake the Eurodollar, a dollar that exists outside the scope of the traditional system.

Anyone, anywhere can create EUSD by interacting with a smart contract on one of 30+ different free open source blockchains (Ethereum and its competition). The minting is controlled by an algorithmic central bank represented by ECR tokenholders and they must own EPIC to do so. It is a fully-reserved, autonomous, decentralized banking system.

ECR

In mid-2018 or so, the vision for what is now Epicenter DAO began to form: We started from the question of how to put the world on a firmer footing economically, with a rational, sustainable financial system based around non-interest-bearing currency. Epicenter DAO (Decentralized Autonomous Organization) is entirely decentralized. We have no physical presence: no corporation, no board of directors, no office, no lawyers. No executives, no VC stakeholders, no lobbyists.

In this design, the seigniorage benefits accrue to us, the user-owner-operator-creators of ECR - Every Citizen’s Reserve, rather than a privately-owned government-enforced currency cartel.

In this, we execute a proven successful formula, following in the footsteps of the holy Trinity of Ethereum DeFi, ETH/MKR/DAI, to which our answer is EPIC/ECR/EUSD. Coming 5 years later, each component is improved individually, and they work together better, with enhanced censorship resistance being the focus.

Links

EPIC Blockchain Protocol - epic.tech

Epicenter Ecosystem - epicenter.epic.tech

Epicentral Information Resources - epicentral.io

Telegram Community: @EpicCash

Censorship Resistant P2P Funding Resource - EpicFundMe.com

Official Twitter: EpicCashTech

YouTube Channel: Epic Cash

Listened to Adams, went to your website to download. Basically, useless. Version bugfix here, acronyms there, Linux, Apple Windows there... basically, this appears written for the people who created it, not for the end user. Extremely disappointing. Can't just tell us in plain language what to do, of course. E.g., Windows, do this. Android do this. And like all the tech platforms, one is on one's own. All you get are response bots, autoreplies, etc. More than disappointing.