FUNGIBILITY

The Achilles' Heel of Obsolete Cryptocurrencies

Blockseer Censors Transactions at the Pool Level

Source: Modern Consensus

Bottom line: now, paying the exorbitant BTC fee isn’t enough to ensure a fast transaction. If the pool that wins the next block wants to filter your transaction for whatever reason, they can. Your transaction must wait indefinitely, until an open pool becomes available.

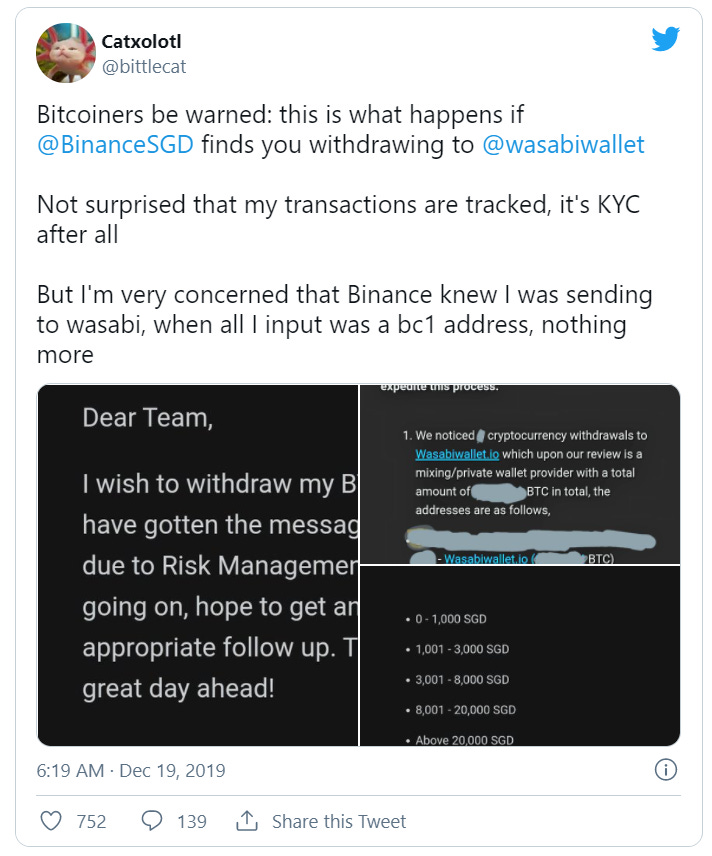

Binance Singapore Prohibits Wasabi Withdrawals

Source: Blockonomi

Translation: BTC is, for most users, a permissioned network and therefore a very censorable experience. Here, a customer of Binance learns that they are not free to withdraw ‘their’ BTC to a type of wallet service that Binance doesn’t like.

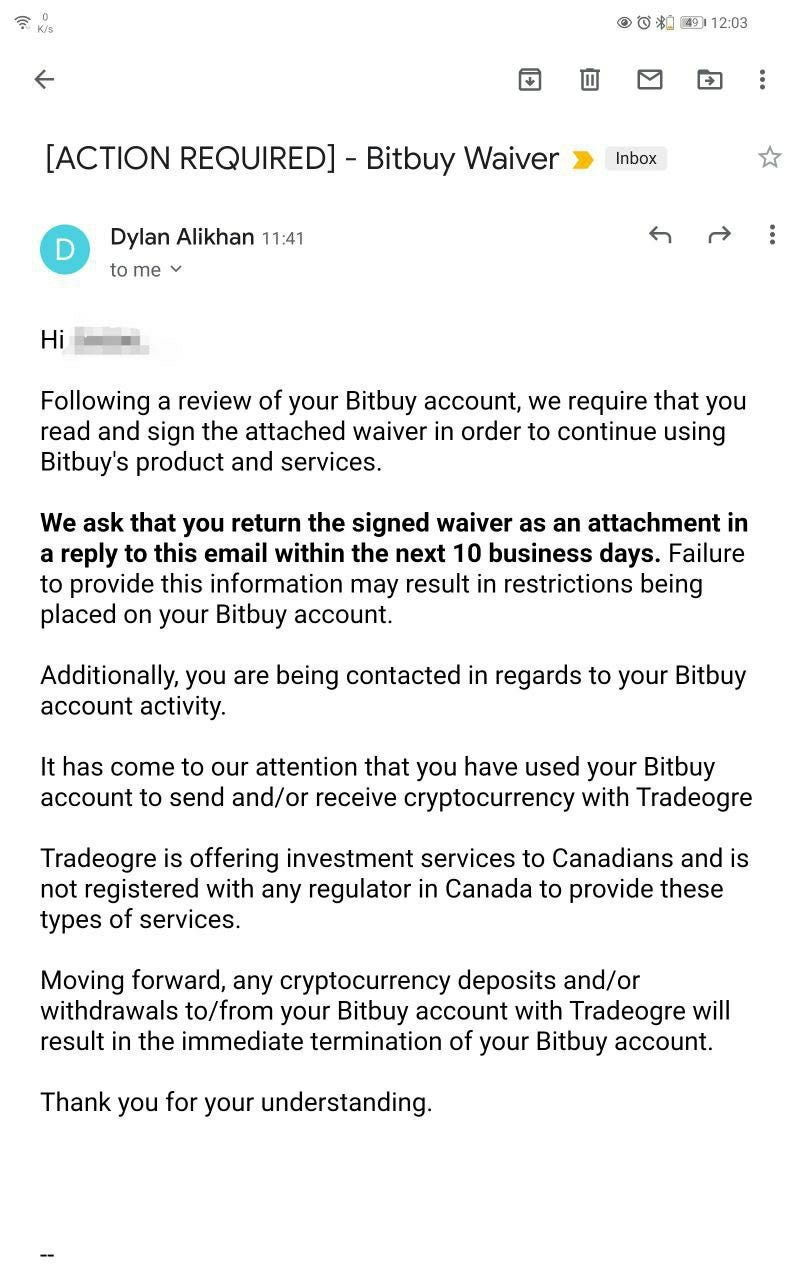

TradeOgre Deposits Censored

What’s going on here? If you buy BTC from TradeOgre and send it to Bitbuy, they will shut down your account.

Off-Chain Consensus Process

We now have a situation in which a political process determines the validity / acceptability of coins. If the US government decides that you are a “drug kingpin” then, just as in the legacy system, your assets will be frozen.

Rules For Thee, Not For Me

Coins on darknet market = bad! -> these are tainted, you can’t use them anymore.

Except if you buy them from the government, now they are un-tainted. Magic!

We used to have a paradigm in which the network nodes would determine the spendability of coins. Now we have a secondary concept where in addition to being valid coins as per the network, they must not be considered unacceptable by the maintainers of the “no fly lists”.

Investors Jumping Through Unnecessary Hoops

Shark Tank actor Kevin O’Leary describes the lengths to which he goes to avoid tainted coins - buying equity of companies that are doing the mining.

“Two kinds of coin” - when a money/currency is not fungible, it is not as useful as one that is, since it can be used in a subset of contexts vs. universally. This is a major problem for users of obsolete surveillance blockchains such as BTC.

Andreas Antonopolous on Fungibility

”Tainted coins are very destructive. If you break fungibility and privacy, you break the currency. It is possible to attack Bitcoin in the ways we haven’t seen yet.”

Do you have other examples of how a lack of fungibility causes unnecessary friction that impedes the growth of the cryptocurrency space? Drop me a line on telegram: @EpicCash