Disclosures / bias confirmation: long EPIC, no positions in other coins but if I were still trading, I’d be short ZEC and ARRR vs long XMR, market neutral in USD terms.

Spoiler Alert: if you are paying hard-earned money to someone so they can tell you “Mimblewimble sucks - take my word for it!” you should ask for a refund.

$EPIC is much more than a mere “privacy coin”.

Sure, it offers the same “100% confidential transactions” experience to the end user as Monero and Pirate Chain, without the confusing complexity of Zcash, but its true potential is so much more than that.

$EPIC is the key component of the EPICENTER ecosystem, an engine of entrepreneurship focused on the buildout of d-commerce infrastructure at the grass roots level worldwide. EPICENTER allows people to build decentralized financial applications that use EPIC as their native unit of account internally. Epicenter DAO, for example, is organized to put forth the EUSD token, which leverages EPIC and its own ECR token to provide a fully-reserved decentralized banking system permissionlessly to businesses. Organizations such as Fast Epic in Poland, which is developing a secure anonymous messaging system that uses milli-epic as computational gas on an IBFT shared blockchain data structure, have recognized the unique value that EPIC as a currency has to their business. Epicmine.org focuses on ease of use, and is working on a one-click Nicehash-style miner for newbies. EpicFundMe.com helps content creators avoid censorship and cancel culture. Epic Sh*t Swap offers a recycling service for your tired bags, paid for in cold hard cash.

When you think about Monero, you think “darknet coin”, right? While we believe in each person’s absolutely inalienable rights with respect to their privacy, that is not the animating spirit of why EPIC, as a currency, features privacy. It has privacy because it needs to be private in order to be fungible. We need EPIC to be private and fungible for extreme censorship resistance so that the EUSD based upon it can be transparent and regulatory compliant. We need EPIC to provide the scarcity, so that EUSD can provide the infinity. ECR helps us keep our heads straight in a hyperstagflationary post-Covid world. While other assets mentioned in this report have privacy as their reason for existence, EPIC has privacy as a byproduct of having designed for other needs and it needs to be evaluated in a different light.

At a technical level, the Epic Blockchain protocol is perhaps best thought of as a massively distributed Google Sheets-type shared spreadsheet, one with 21 million tabs. Each tab (coin) holds 100 million cells of data storage capacity - say, a grid of 10k * 10k. The entire system is interconnected in such a way that every minute, the data updates instantly for everyone simultaneously, without delay - keeping the data in sync across millions of people worldwide. This system, based on distributed consensus, gets more secure and cheaper to operate as time passes. It is not inexpensive to operate, relying as it does on the consumption of electricity to operate, but it is a value creator rather than a cost center; an investment rather than an expenditure.

In a “privacy coin” use case scenario, an effectuation of value transfer is achieved through the common medium of the blockchain’s cryptocurrency. In EPIC, the use case is more broad - users are paying for an ultra high-assurance, high-availability, fault-tolerant, disaster-resistant, anti-fragile, resilient immutable permanent cloud database storage system without any ongoing operating cost. It never glitches, never goes down, runs indefinitely, self-funds, and grows ore secure over time. When viewed this way, it’s clear why pigeonholing EPIC into the “privacy coin category” is unnecessarily myopic.

$ZEC Zcash

User Experience

ZEC has 2 types of addresses and 4 types of transactions, depending on whether the transaction is transparent or shielded, and if shielded, how much. For those who think privacy is easy and simple, I invite you to install the Zcash wallet and get your head around sprouts and saplings and merkle trees. Perhaps because of this complexity, the majority of Zcash users don’t take advantage of the privacy features at all.

Wallets

According to the Zcash website:

These wallets work with transparent transactions only:

Atomic

Bitpie

Carbon Wallet

Coinomi

Cryptonator

Exodus

Jaxx

Holy Transaction

Magnum Wallet

Mobi

Trust Wallet

These wallets work with shielded transactions only:

Nighthawk

These wallets work with both transparent and shielded transactions only:

Unstoppable

Zecwallet

Judging by App Store reviews, this is confusing for users. If I’m using a “privacy coin” - why are 70% of wallets unable to use the privacy features? Why do I need to know the difference between Sprout, Sapling, Canopy, t-z shielding, deshielding, and so on? In a world of 10k digital assets competing for scarce bandwidth among developers, exchanges, and other key infrastructure providers, this represents a significant point of friction and barrier to adoption.

Mining

In order to mine Zcash, you must own a special-purpose ASIC. Zcash runs a single algorithm, Equihash, that can only be mined on equipment produced by a few companies, most notably Bitmain. Right now, you can get one used from Amazon.com for a cool $14,999.

Once you spend your $15k, here is how the numbers break down:

Spending $15k in capex = $30/day in gross revenue. Since everyone’s electricity cost varies and many use solar, let’s just use the revenue and ignore the cost side for now.

In order to earn this $900/mo revenue, this device must run 100% of the time. It generates loud noise (imagine a dental drill mating with a vacuum cleaner) and a lot of heat, so you will need to manage airflow and find a suitable location. This $900 will decline by ~50% in the next 3-6 months, making it extremely unlikely for a buyer to experience a net ROI over the entire investment cycle.

This device will be obsolete in 18-24 months (i.e. it will produce less in coins than the electricity it takes to create those coins) and then it becomes toxic e-waste scrap. These disposable single-purpose machines can’t do anything except calculate Equihash, and that is only valuable to mine ZEC, so once they are done, their highest and best use is providing jobs for kids:

ZEC equihash hashrate is 4.7 G sol/s. Every single one of these devices will be occupying space in a landfill within 2-3 years.

Monetary Policy / Emission

ZEC has a hard limit of 21MM coins, currently 11MM of which are emitted.

% Emitted / % Remaining

11.2MM / 21 MM 53%

CoinGecko: ZEC Circulating Supply

Over the next 5 years, ~5 million ZEC will be mined - 80% to ASIC miners and 20% to Electric Coin Company. Both must sell into the market to support operations costs. Contrast this with EPIC, which is mined by predominantly hobbyists, users who value the functional properties of the coins as tools. Epic is much better positioned to benefit from network effects and virality.

Computing Resources Required

Host full Node: 63GB disk space - this means you will not be running a full node on a low end mobile device

Chain Stats: ZEC Block Explorer

Usability

To send a Zcash shielded transaction, you must know the difference between 2 types of addresses, depending on whether a transaction is transparent or shielded, and if shielded, how much. The computation required to generate a transaction is significant, leading most people to go for convenience and send an unshielded transaction. Fully 90% of ZEC transactions do not make any use of available privacy features, underscoring the challenge.

Funding & Governance

10-20% of coins go to the Electric Coin Company, a private for-profit business entity owned by banks and hedge funds. Coinholders are dependent on ongoing goodwill of this central player for development of the technology.

One may ask, given that the original promise to limit the Founder’s Reward to 10% (2.1 million coins, front loaded!) has been broken and Electric Coin Company continues to operate in the red, what the future for this project and ones that depend on it as a technology pipeline (ARRR) might mean.

Nature of Privacy Offered

ZCash is best described as a “10% private coin” since 90+% of usage involves no privacy at all:

According to Zdash.info, the % of fully shielded transactions has been between 4-10% of activity. Why is this a problem? Because opting in to privacy makes you suspicious - why would you use it unless you have something to hide (or so the thinking goes, even though a recent RAND study confirmed that <1% of cryptocurrency transactions are actually illicit)

Given admissions such as this from Chainalysis, it is a mystery why people continue to include ZCash in lists of “privacy coins” - perhaps it belongs alongside Dash and Bean and other “sometimes private, kinda, I guess” coins.

Coincidence Theories - only for “nutty conspiracy kooks” - tinfoil hat warning

Trusted Setup requires you to believe that the wealthy institutional investors (i.e. banks) behind this project and the NSA are being completely honest with you in their assertion that it’s nothing to worry about. Mere mortals such as this humble scribe can’t possibly understand the ‘moon math’ involved, so we’ll just have to take their word for it.

The only exchange to support shielded withdrawals is Gemini, whose key selling feature is their cozy relationships with regulators.

I’m just the messenger here, not taking a stance. Moving on,

$ARRR Pirate Chain

$ARRR wins plaudits from this author for their decision to enforce always-on privacy (inherited from Zcash) at the protocol level however this means that generating a transaction in a mobile device or older PC renders it inoperable for a fair bit of time. In a high traffic scenario such as point of sale where seconds count, this could be a barrier to adoption.

User Experience

Wallets

According to the Pirate official website, the project offers certain options:

Desktop - Windows, Mac, Linux

Mobile - Android

Sharing as it does the code from ZEC, wallet software for ARRR is subject to the same limitations - namely, that

Mining

Like ZEC, whose code base it shares, ARRR is mined on ASIC exclusively, using Equihash algorithm. Here are the current figures:

Spending $15k in capex = $32/day in gross revenue. Since everyone’s electricity cost varies and many use solar, let’s just use the revenue and ignore the cost side for now.

In order to earn this $960/mo revenue, this device must run 100% of the time. It generates loud noise (imagine a dental drill mating with a vacuum cleaner) and a lot of heat, so you will need to manage airflow and find a suitable location.

Reducing youth unemployment in emerging economies, one kilohash of sols at a time.

Did you know that this type of electronic scrap is often burned to yield the gold inside? It exposes children to carcinogenic smoke for $1 a day. This e-waste scrap yard is in Ghana, the same place people from the Epic community are planting trees and teaching people to #minecryptoathome.

ARRR equihash hashrate is 1.5 G sol/s - isn’t this a problem, given that 4 ZEC pools each have enough to 51% attack the network? No, because they use Komodo dpow. (Props!)

Monetary Policy / Emission

ARRR has a hard limit of 200MM coins, currently 180MM of which are emitted.

% Emitted / % Remaining

183.7MM / 200 MM 92%

CoinGecko: ARRR Circulating Supply

Computing Resources Required

To host full node: 9GB

Chain Stats: ARRR Block Explorer

Flies in the ointment

ARRR has trusted setup, though having had personal meatspace contact with a number of the mateys, I’m inclined to trust the off-chain signal “proof of gut feeling” and the sincerity of their intention. This video does a good job of explaining the measures they’ve taken regarding this issue and why it may be less concerning than it seems at first.

The project has been the victim of one of the most shamelessly cynical pump and dump schemes in recent memory, put forth by promoters surrounding Jeff Berwick, who assured elderly newbie investors that it would one day displace BTC as the global reserve currency, presaging further 1000x gains. While the market cap potential of this type of product may well be $2.4 trillion dollars (based on the call at the time), this expectation in the mind of investors is problematic for social relations in the community.

Long Term Economic Security

If you had an Antminer Z15, what are you going to mine, ARRR or ZEC? Generally, whichever is most profitable. Hashrate follows price. ZEC has deep-pocketed backers to fund further development and ARRR does not, so over time a features gap may emerge. Implementing halo is not a trivial task and not without risk. Given that 90% of ARRR is already emitted, and its owners mostly bought it for pennies, where is the incentive to continue mining, especially when ZEC still has 5 million very expensive coins on the table coming for Equihash over the next 5 years? It would be wonderful to know their thinking around how to navigate these issues.

Exchange coverage

It goes without saying that to transact on a centralized exchange platform, such as TradeOgre and KuCoin, which together represent 86% of volume, negates the benefits of privacy.

TradeOgre is an illegal business on the same footing as the Silk Road. Transacting in cryptocurrency without proper KYC/AML controls carries a hefty prison sentence, as Arthur Hayes discovered. KuCoin presumably follows the appropriate Seychellois laws, however in both cases, users’ funds are exposed to risk while using custodial services. CoinEx and Hotbit have both scammed ARRR holders, highlighting the danger here.

Atomic swaps are on the horizon, so thankfully both these problems are solved. We at Epicenter have committed to support ARRR/EPIC atomic swaps in our p2p venues, as well as running a full gateway to offer ARRR/EPIC and ARRR/EUSD liquidity channels. In terms of future value potential for ARRR holders, we have also decided to offer an air grab of 10k ECR tokens to be split among keyholders who claim them (details forthcoming in our main Telegram group @EpicCash)

$XMR Monero

$XMR features always-on privacy by default for all transactions, which is awesome. However, the specific way it achieves it results in serious scalability challenges. The "ring signatures" that act as decoys bloat the blockchain. Currently at around 70gb, it would be multiple TB at BTC-level usage.

Mining

XMR is a single-algo network running RandomX, which is a CPU-targeted algorithm. You technically can run it on a GPU, however it will run so slowly that it doesn’t make much sense.

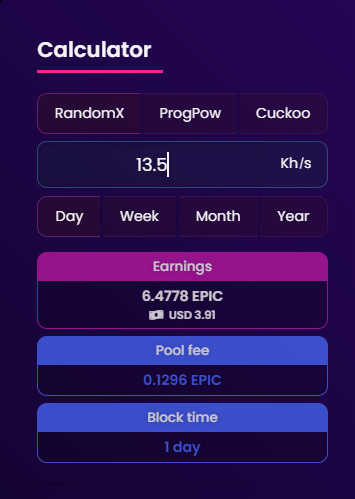

An AMD Ryzen 9 3900X produces approximately 13,500 H/S on RandomX. What will this earn?

This processor, running 100% of the time, generates $24 per month in income.

Funding & Governance

Funding primarily comes from the Community Crowdfunding System (CCS) involving donations to individual initiatives that find appetite.

Future-Proofing

Currently set at 11, the ring signature approach is coming under threat from organizations such as CipherTrace and the IRS, which recently doubled its $1.25MM bounty to fund research into deanonymization techniques.

And therein lies the rub. Unlike Mimblewimble, which melts and reissues coins every time they are spent using a cryptographic process known as Pedersen Commitments, the Monero blockchain leaves a trail of footprints to follow in the blockchain. A transaction may be sufficiently private for a user's purpose today, but what about 5 years from now? In 2021, a man in Sweden was sentenced to prison based on on-chain activity from 2011.

Monetary Policy / Emission

XMR has a practical limit of 18.4MM coins, however the supply is technically infinite, as there is a “tail emission” indefinitely. The excellent Monero Subreddit has extensive discussions as to why this may be preferable to a fixed supply.

% Emitted / % Remaining

17.9MM / 18.4MM 97%

CoinGecko: XMR Circulating Supply

Computing Resources Required

To host full node: 70GB

Chain Stats: XMR Block Explorer

Flies in the ointment

The particular methodology used to achieve privacy in the case of Monero is unpacked in this excellent presentation from

Zcash’ Ian Miers: Satoshi Has No Clothes: Failures in On-Chain Privacy

Zcash & Ryo contributor Fireice_uk maintains a compendium of resources

Zcash’ Bruce Wagner really doesn’t like Monero and the feeling is mutual

KNACC attack again from Fireice_uk

If the singular purpose of the asset is privacy and that feature is called into doubt, what does it mean for the future of the project, especially seeing as how 17.9 million of 18.4 million coins already exist and the rewards for miners today relatively low?

Some are unhappy about attempts to reach a rapprochement with regulators: Monero Policy Working Group EU. A splinter group calling itself “Monero Uncensored” has recently emerged in response to censorship in a common telegram group. A key contributor, Diego Salazar, was recently unceremoniously run out of town in a way that underscores the challenges of governance in open source community projects.

$EPIC

Enhanced Censorship Resistance Bitcoin

Flies in the ointment

“But I heard Mimblewimble was broken?” Actually, not: Factual inaccuracies of “Breaking Mimblewimble’s Privacy Model”.

But I heard you can’t do atomic swaps? Also not the case: MWC Swaps are running in production on the same code base.

“Mimblewimble isn’t nearly as private or as fungible as Monero” - oh really? What % of XMR transactions are executed through centralized exchanges, and carry travel rule information? EPIC is acquired 100% by mining or via p2p dex, it is not on any centralized platform at all.

Epic is not merely a privacy coin, it is a form of Bitcoin that uses anonymity and privacy to enhance censorship resistance and provide fungibility. Its primary selling point is not privacy, rather scalability. At only 1.6gb, the entire blockchain fits on a cheap mobile device. Epic has considerable utility irrespective of anything related to privacy, for example as a source of high grade superfluid collateral for algorithmic stablecoin EUSD.

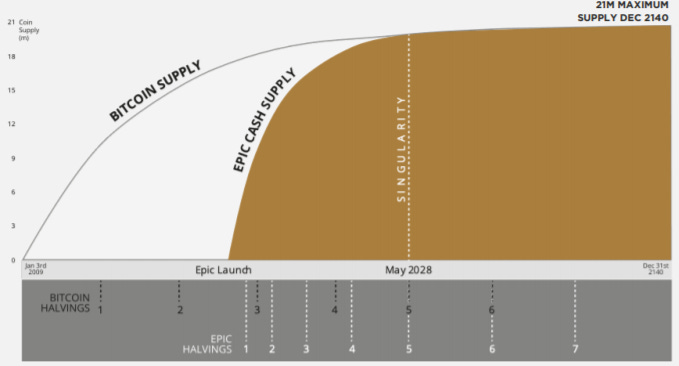

Epic fulfills its necessary purpose in the Epicenter network as "https://bitcoin", a job it performs adequately as the network nears its 1 millionth block and 3rd halving, from 8 to 4 coins per 1 minute block.

You can't mine ARRR or ZEC unless you have an Equihash ASIC such as an Antminer Z15. You can't mine XMR on your GPU. You can mine EPIC today on anything from an old laptop all the way up to an AMD 7742 EPYC beast on RandomX, and anything from an Nvidia 1060 3gb up to a 3090 or AMD Titan V100 on ProgPow. Incidentally, if you want to mine with GPU, EPIC is your only option among this list. Proof of work is not simply a network security concept, it is also a core tenet of egalitarian distribution - we think about proof of work as an “evergreen ICO”.

Mining is where Epic truly shines. Its groundbreaking Freeman Proof of Work increases ROI for miners by dramatically reducing energy consumption, e-waste footprint, and obsolescence / timing risk.

Epic has a configurable cipher policy called Feijoada wherein any arbitrary number of algorithms can be seamlessly integrated on the fly. Currently configured as 60% RandomX / 38% ProgPow / 2% Cuckoo Cycle, the next two in the pipeline are RandomARM and SHA3. Epic beat Monero to market with RandomX by months in 2019, and continues to be a leader in innovative open source software designs.

Mining $EPIC

9.2MM of EPIC coins remain to be mined. Of these, 8.6MM (94%) are available in the next 7 years.

Mining on CPU: Yes

60% of blocks go to CPU on RandomX. That same Ryzen 9 in the above example that earns only $24 per month can earn $117 per month mining EPIC at 40% less power consumption and the device can be used for other purposes when it’s not mining. Let’s say you were a Monero maxi, why not mine EPIC, sell 25% of it for XMR and keep the rest for free? The ROI on an apples to apples basis is currently over 400% greater mining EPIC than mining XMR. Let that sink in for a moment. You can earn 1 XMR in 80% less time and 40% less electricity, plus regain the use of your device.

Mining on GPU: Yes

38% of blocks go to CPU on Progpow. Most GPU miners today are mining ETH, so let’s look at the economics of that. An RX580 8GB running ETH 100% of the time will generate approximately $2.90 per day - $87 per month

The calculus for ETH gets even more exciting. Using miners such as SRBMiner, TTMiner, XMRig, or HiveOS, many power miners are dual-mining something else the other 62% of the time they can’t mine EPIC on their gear.

Presently, an RX580 8GB GPU produces approximately $2.90 per day in revenue mining ETH flat out 100% of the time. That same hardware mining EPIC 38% of the time (and using of course 62% less power) produces $2.10 per day:

Coupling this while running ETH the other 62% of the time yields (.62 * $2.90 = $1.80)

Dual mining ETH+EPIC yields $3.90 instead of $2.90, or a 30+% increase in ROI.

Explained another way, it takes 30% less time to generate 1 ETH mining EPIC than it does mining ETH directly. Are we detecting a pattern here?

Monetary Policy / Emission

EPIC has a hard limit of 21MM coins, with an identical emission schedule to BTC post May-2028. Epicentral.io and the Epic Tech whitepaper are good places to start.

% Emitted / % Remaining

11.8MM / 21MM 56%

CoinGecko: EPIC Circulating Supply

Computing Resources Required to host full node: 1.6GB

Can run full node on mobile

Full mobile proof of work + local node coming, work underway for quite some time.

Chain Stats: EPIC Block Explorer

Exchange coverage

Where can I buy Epic Cash? It must be a sh*tcoin if it’s not on any good exchanges, right?!? 🤦♂️

In keeping with the Epicenter philosophy of individual self-sovereignty of one’s financial affairs, we have centered our efforts and focus around the creation of long-term sustainable dex infrastructure. In addition to the excellent ViteX non-custodial non-KYC exchange, our community has creatively found ways to connect Stellar, Pancake Swap, and Wanchain as well, with many more on the way. This is a sneak peek at the preliminary coverage grid for ECR/EUSD

In this way, it will be possible to purchase EPIC (via EUSD, which is simply a claim check for $1 worth of EPIC) on literally every smart contract platform’s dex infrastructure. As long as a platform is open, public, permissionless and neutral, there is no reason not to, and most importantly, no barriers to making it happen.

In my 3 years of working on this project so far (a bit of history here - the first draft of the Epicenter Stablechain whitepaper was posted in December 2018 on Bitcointalk) I have probably spoken to 50-100 exchanges and gained extensive insights into this part of the industry.

I personally consider the absence of coverage on CEX platforms such as Coinbase and especially Binance to be a major blessing for the fledgling Epic Blockchain. Coinbase’s duty to earn profits for its owners presents it with morally dubious propositions such as monetizing its users’ data against them by selling it to law enforcement. Binance is the “Creditanstalt of Crypto” and will cause some serious pain when it rugs, likely due to Tether no longer being able to keep up the con.

$EPIC will never be more difficult to buy than it is now. It will never be on fewer wallets. It only has room to grow from here.

Future-Proofing - Privacy

Unlike XMR, which grows more bloated as it adds rings - Triptych takes the ring size from 11 to 128 - EPIC gets proportionally leaner as more people use the system. This is due to the special form of hypnotic magic known as Pedersen Commitments. Simply explained, this enables an offsetting netting of the two sides in the settlement equation, so that if Alice, Bob, Carla and Dave all transfer a bunch of coins back and forth, it simply records the net change.

This is, if you think about it, a more solid footing for privacy than hoping that you will hide in a larger and larger group of people - (11 today, 128 tomorrow, after that…?) - the way Mimblewimble achieves privacy, once the ice melts, you can’t tell what the ice sculpture looks like:

Strategically, we like the “Goldilocks level” of privacy that the current configuration provides. Unlike Monero, which is the target of a $1.25MM IRS bounty program to crack it, EPIC privacy preserves fungibility and deters data pirate business models in such a way that crime fighters, regulators, and public policy makers don’t have a problem with, so they are less likely to interfere. We don’t see a conflict between anonymity/privacy and compliance/public policy/regulation

Should more privacy be desired by the market for special-case situations, there are multiple paths to achieve this:

Grin-Aquamenti: Conjuring decentralized liquidity - this proposal enables people to throw their transactions into a “hiding pool” where they accumulate and are batched with others, providing a greater anonymity set. Using this approach, “absolute privacy” levels similar to ZK techniques may be reachable - definitely a promising area of research that we’re keeping an eye on.

Lelantus - As proven out in current production implementations Bean and Firo, Lelantus provides very strong privacy.

We have a lot of building to do that takes higher priority, plus this market segment is unattractive - we work hard to build positive equity for our brand - so we will leave the darknet market opportunities to other chains because we’d rather be the money for Girl Scouts fundraisers, church bake sales, kids’ lemonade stands, and so on than a payment rail for online Viagra or pipeline ransoms.

Finding a balance between civil liberties and the need for society to track down bad actors is a tough challenge that shouldn’t be rushed, so we’re pretty comfortable with the settings as they are and letting other networks be “bleeding edge”, we will be “leading edge”.

Thank you for taking the time to consume this mining-focused deep dive into privacy coins, which hopefully clears up any misinformed baseless fud regarding EPIC. If you like content like this, join me at Applied Cognition on Reddit.

Max Freeman

Epicenter DAO

Absolutely fascinating! Thanks friend

You're very welcome, my pleasure. Any suggestions for next time?