What is Bitcoin?

“Bitcoin”, as described by its creator Satoshi Nakamoto, is “a p2p electronic cash system”. It leverages distributed consensus, which is a very particular form of network design, along with computational proof of work and a carefully calibrated set of incentives. It is designed for semi-anonymous operation, unshackled from the need to provide personally identifying information to send a payment.

Its creator repeatedly reiterates the importance of eliminating trust dependencies, mentioning this ten times in the Bitcoin whitepaper.

It describes an economic paradigm in which there is a maximum amount of currency units (21 million) and the emission of those coins follows a specific predetermined formula wherein the rate declines 50% every 4 years. This allows Bitcoin to serve as a financial battery, enabling people to contribute value into the system confident in the knowledge they will be able to get it out later. The future supply at any given point in time is known, eliminating the risk of arbitrary inflation. The emission is, in the words of one of today’s leading sages Robert Breedlove, “beyond the machinations of man”.

Bitcoin is a synthetic monetary commodity that serves well two of the three main functions of money: store of value and medium of exchange. It is presently poor as a unit of account due to price volatility, which is one of the major remaining unsolved problems for cryptocurrency. Ironically, the volatility attributed to Bitcoin is actually 100% attributable to the conditions in the fiat markets, as one Bitcoin is always one Bitcoin, and the supply is always 21 million.

What problem was Bitcoin created to solve?

Before Bitcoin, avoiding the “Double Spend Problem” required the reliance on a central server, which made the service censorable. This led to the demise of earlier networks such as DigiCash. It also solved the “Byzantine Generals problem”, a longstanding computer science challenge.

How does it do it?

It enables the world to enter a competition to destroy electricity in a giant computational coin flipping contest to share a drip feed of coins. Each block, which is a bundle of transactions appended permanently to the ledger, a "coinbase reward" of freshly minted coins is created, diluting the existing supply. This creates a connective link between the market for electricity and the market for Bitcoin, establishing a clearing rate between the physical and the digital realm. It does this by putting a price on the creation of new information, and specifying conditions in which that new information can be created.

What functional properties did Bitcoin have that made it so special initially?

It was:

Trustless - you didn’t have to trust in anyone or anything except the open source code itself, to know that you weren’t being taken advantage of. Applications such as Satoshi Dice emerged atop the network, promising provably fair odds for games of chance, eliminating the potential for fraud and malfeasance.

Permissionless - you didn’t need to fill out any forms, engage with customer service, or submit your identity documentation to anyone in order to use the network. Simply downloading the free open source code was enough.

Universally Accessible - anyone, anywhere, anytime could use the network.

Censorship Resistant - no one could deny your access to or usage of the network. The network itself could not be shut down.

Reliable - Once you sent a payment, it would reach the destination 100% of the time, as long as you paid the fee. Blocks occurred like a metronome, uncannily close to the intended 10 minute cadence.

High Availability - There were no service outages, the network remained functional no matter what.

Immutable - Once you sent a payment, there was no getting it back.

Self-Sovereign - If you owned the keys, they were your coins - full stop. There could be no claims levied against your property, no dunning could be possible. In the immortal words of Andreas Antonopolous, “Not Your Keys, Not Your Coins”.

Unconditional - Fee simple ownership of property with perfect title precluded anyone from laying claims to it.

Supranational - The network existed outside of the context of existing institutions, living entirely on the Internet. It could not be brought under the heel of any nation-state.

Borderless - Anyone, anywhere, armed with only an internet connection, could transact with anyone else globally in a single seamless network.

Fungible - One Bitcoin was one Bitcoin, regardless of how many fiats it was. Each one was as good as any other.

Frictionless - payments were very easy - within 2 seconds of creation, a transaction irrevocably entered the mempool, enabling you as a sender to know with certainty that the recipient would receive it within a reasonable time.

Fast - much quicker than competing alternatives

Cost Effective - payments were also much cheaper than alternatives, especially wire transfers.

Semi-Anonymous - With a modicum of opsec, users could keep a low profile with respect to the level and nature of their wealth. This has important consequences for physical security in the real world, as Hal Finney’s widow discovered when armed men arrived at her doorstep based on footprints left in the blockchain. A Russian man in Sweden was sentenced to prison in 2021 for his role in what occurred on chain in 2011, underscoring the fact that surveillance blockchains are forever.

Confiscation Resistant - Being semi-anonymous, users could, with a bit of caution, avoid the predation of those who wish to steal their wealth for whatever reason.

Charlatan Resistant - Its supply could not be inflated or gamed with fractional reserving, rehypothecation, derivatives or other unallocated ownership schemes.

Neutral - the network offered an equal level of service to all, at all times.

Favored - Existing outside the context of pre-digital regulatory frameworks, Bitcoin offered attractive asset protection features for flight capital.

Transparent - You could compile the code yourself. Everyone could see everything that happened on the network, creating a web of independent trust.

Egalitarian - in the words of its creator, "1 CPU, 1 Vote".

How have these properties been degraded over time?

In 2009, the Bitcoin blockchain pioneered the concept of trustless operation. Today in 2021, trust dependencies are everywhere, compromising the structural integrity of the design. A robust system designed to resist catastrophic failure has reintroduced the capacity for catastrophe by introducing external dependencies, undercutting the entire original premise and purpose of the system.

Trustlessness

Nodes - Users rely on remote nodes, which means they trust someone else to faithfully represent the canonical chain state.

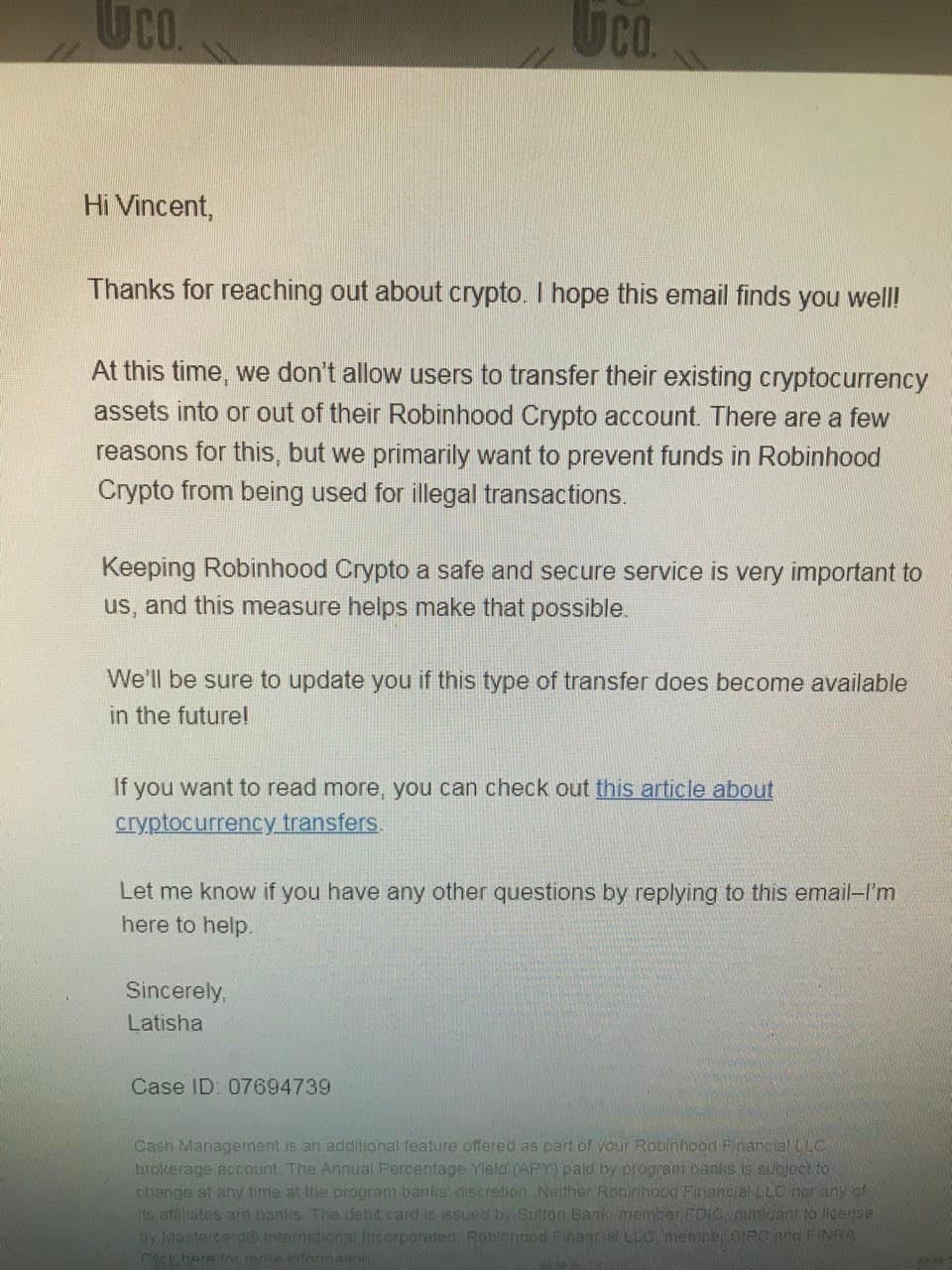

Custody of Funds - Users rely on custodial platforms such as Coinbase and Binance to manage their coins on their behalf. This transitions the service model to that of traditional finance: Just as bank depositors do not own title to actual funds, rather an IOU from that institution, users who interface with the Bitcoin network this way necessarily subordinate their interests to those of the company they entrust with their money. Millions of people in 2021 have bought Bitcoin on Robinhood, not knowing that they don’t own the coin directly and cannot withdraw it.

Mining - Increasingly, mining pools employ transaction filtering software that refuses to process transactions noted as blacklisted. If you send a transaction and either you or your counterparty have been connected to activity deemed unsavory, however tangential the link, your transaction will be filtered out as “high risk”. You are trusting that the mining pool your individual miner connects through will not filter your transaction.

Transaction Blacklists - Who maintains these databases anyway? Users must trust that they somehow don’t end up on one of these lists, should they choose to use the network unassisted.

Tainted coins - Above all else, users must now be ever vigilant against receiving coins that have been involved in illicit activity. Instead of trusting the network to deliver the coins you bought, and that those coins would be later accepted by that same network as valid, you now need to judge the probity of your counterparty, lest you received dirty money, which could expose you and yours to significant legal consequences.

Permissionlessness - Users today accept it as normal that buying Bitcoin involves the provision of identity documentation, however this was not originally the case. Money transfer licenses that need to be obtained on a state-by-state basis slow down would-be entrants to the financial services business.

Universal Accessibility - While the network itself remains consistently functional, the intermediaries suffer outages that block user access, often during the most critical times.

Censorship resistance - While the BTC network is itself technically uncensorable, from the user perspective the story changes. If you violate Coinbase terms of service, they will close your account and keep your money. The network is effectively close to 100% censorable if considered this way, on a user count basis. Censorship resistance is the signal property without which the entire concept of Bitcoin has no ability to endure. What does it matter if the network itself can’t be shut down, when groups of people, off chain, can take action to shut down your access to it?

Reliability

Delivery Time Unpredictable - If you are on one of the filtered lists, you may wait hours or days for your transaction to be processed by one of the few remaining open pools. If you send a low fee transaction during times of extreme market stress, it may not clear for months, perhaps indefinitely as block space commands an increasing premium.

Block Time Erratic - Because the network is so heavily dependent on Chinese infrastructure, with 70+% of hashrate coming from just two provinces in that great nation, any disruption there leads to blocks coming either too quickly or too slowly.

High Availability - It has become an open secret that exchange trading platforms suffer outages during the times they are needed the most. When users interface directly with the network, this cannot happen. The reliability of the 10 minute block time is also increasingly unpredictable.

Immutable - Institutional traders know well the growing friction around tainted coins that need to be kicked back. It is no longer the case as it once was that once a transaction enters the mempool, that it will be processed and acknowledged as received by the counterparty

Self-Sovereign - Ownership of coins has transitioned into “ownership of an account with putative interest in said coins, which may or may not exist”. Purchasers on platforms such as Robinhood cannot even withdraw “their” coins

Unconditional - That interest now exists subject to a great number of conditions, both with the depository institution as well as those who control those institutions i.e. governments.

Supranational - Thus, while BTC exists on the Internet, it is no longer of the Internet. A censorable, trusting, custodial, permissioned, “bank-intermediated ersatz Bitcoin” led by a self-appointed cartel of would-be oligarchs is a thing of geopolitics, not the digital realm. It is a patchwork of high-friction captive walled gardens, not the new Internet of Money.

Borderless - Those borders lead to phenomena such as the “Kimchi Premium”, wherein Koreans are soaked for a 20% surcharge to move money between KRW and BTC. The madness of 2017 saw dhows loaded with gold bars and Ledger Nano’s plying the waters of the Arabian Sea.

Fungible - Tainted coins add friction at every stage of transfer, accumulating cost like plaque in a formerly fluid system. Friction increases costs all along the chain, serving as sand in the gears. Bitcoin is now more akin to diamonds, which must be evaluated bespoke, vs simply validating their authenticity. This adds massive friction and cost to what was formerly simple, easy, and free. Operating BTC is now costly, complex, and fraught with risk. Businesses must be able to afford the $1000/month price of entry for a Chainalysis software license to protect themselves.

Frictionless - payments are now considerably more complex due to the befuddling maze of shifting policies from centralized platforms that intermediate between users and the chain.

Cost Effective - At a recent peak of $62, BTC is more expensive than Western Union, Moneygram, ACH, wire transfer and credit card.

Semi-Anonymous - Today, substantially all BTC transactions now come explicitly with KYC data attached through the “travel rule”, and the exceptions are easily identifiable using software from companies such as Palantir.

Confiscation Resistant - South Korea now directly debits taxes from crypto exchanges. The IRS requires increasingly granular disclosure of digital assets.

Charlatan Resistant - Just as goldbugs know that if you put money in the bank, it’s not your money anymore, and that a Federal Reserve Note and a U.S. Dollar are quite different things, the crypto space is now a gaudy spectacle of debauchery, with luminaries whipsawing hapless noobs for their amusement Tweet after Tweet. The Chinese have a name for this: “Cutting Leeks”.

Neutral - Today, your access to BTC varies considerably depending on where you live.

Favored - Cryptocurrency investments are increasingly subjected to a higher level of scrutiny, reporting, and punitive taxation, making them less attractive than they historically have been. In China, cryptocurrency miners suffer dunning to their social credit score, changing the calculus for operators.

Who has degraded these properties, and why?

While success has many fathers, it is difficult to lay responsibility for failure anywhere in particular. I will leave the speculation about this to others who are more informed, such as James Edwards at Librehash Research, and Kurt Wuckert Jr. at CoinGeek.

I merely seek to describe the existing reality as it exists today (initially May 24, 2021) and strike a contrast between the designs of its creator and its present state.

What can we do about it?

Start mining! You CAN mine Bitcoin at home, and you should. Come to Epicenter Labs: Miami Edition Version 2 on Monday, June 7th at 12:00 PM.

Suggested Further Reading

Saifedean Ammous, The Bitcoin Standard

Robert Breedlove, Medium

G. Edward Griffin, Creature from Jekyll Island

John Sneisen, The End of Freedom

Recommended YouTube Videos

Hidden Secrets of Money - Mike Maloney

Princes of the Yen - Independent POV

Century of Enslavement - James Corbett

Andreas Antonopolous YouTube Channel

Where did Bitcoin come from? - ColdfusionTV