We Have Nothing To Fear But Fearmongering Itself

The tree of liberty must from time to time be watered with the tears of banksters and crony capitalists

My Fellow Freemen,

This is a time of great uncertainty and people are rightfully fearful. In the words of Franklin D. Freeman, “we have nothing to fear but fearmongering itself.”

I would like to reiterate why we created EPIC and put its greater meaning into the proper context. Whether the price is under a penny, as it was in March of last year, over a dollar as it was in March of this year, or any other number, it is the functionality of the network that is important.

The ability to freely transact and trade is under threat. Central Bank Digital Currencies will feature all kinds of restrictions on what you are allowed to buy and who you are allowed to buy it from. Already in the crumbling legacy system, walls are being erected everywhere. Binance has been largely cut off from fiat banking and as a result has reduced its unverified withdrawal limits 97% from 2 BTC to 0.06BTC per day.

If you want to support a political cause through PayPal, you better hope it’s compatible with their values, because if it’s not, the Anti-Defamation League will come after you for hate speech.

If you want to purchase adult content, you can’t do it with MasterCard.

Exchanges such as Bitbuy in Canada will shut down your account if you deposit BTC from TradeOgre. You cannot withdraw from Binance to a Wasabi or Samourai mixer wallet.

Fungibility is the Achilles heel of obsolete cryptocurrencies that allow for unlimited surveillance of their users. The problem of tainted coins has not even barely begun to rear its ugly head yet the friction from the potential of tainted coins has thrown sand in the gears of the entire ecosystem, adding cost, risk, and uncertainty to operating in the digital asset industry.

Cryptocurrency is under attack as never before. Recently in China, 54% of BTC hashrate blinked out overnight as they finally pulled the plug on environmentally destructive ASIC mining. Malaysia chose to steamroll confiscated equipment rather than sell it to send a message expressing their displeasure.

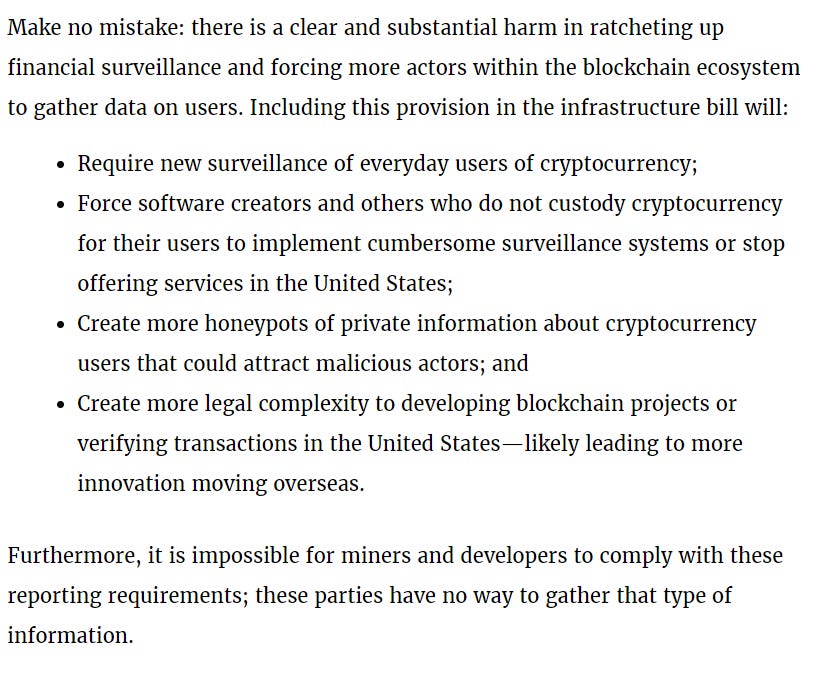

In the United States, the new “infrastructure bill” throws a wet blanket over the small fire we’ve managed to build and will stymy would-be entrepreneurs from innovating for years, if not indefinitely as the USA has now clearly said that it will put its state power behind crushing the newcomer in defense of the incumbent. Banking interests have quite clearly captured the regulators and it's not a fair fight if your competition can change the rules on you.

Crypto is not yet illegal, but it doesn’t have to be to become so unwieldy, expensive, inconvenient and uncompetitive that there is no reason to use it. When you use a spy chain such as BTC, you expose yourself to so many incalculable, unknowable, and irreconcilable risks that the smart play is just to not play at all.

A man in Sweden was sentenced to prison this year for activity that occurred on chain in 2011.

Blockchain cements totalitarianism permanently in place, and the boot will be stamping our face forever unless we move to base layer confidentiality now.

221 million people worldwide now own crypto, and most of them arrived recently, with 100 million new to the space just this year.

Many are like kittens with a laser pointer,

mesmerized by the lines on charts and obsessed with trying to predict whether the price will go up or down, focused on how many fiat dollars they gain or lose as the objective of the exercise.

People who come to Las Vegas know that the odds are against them and they are likely to lose money but they come anyway for the entertainment value.

While there is no doubt value in speculation, as the spectacular success of Doge, Baby Doge, Shiba Inu, and Hex shows, this is not why we created Epic.

We created Epic to deliver extraordinary censorship resistance to Bitcoin. Above all else, it is this supreme censorship resistance, this inability for anyone’s access to the network to be blocked, and the network itself to not be shut down, that is why Epic has any value at all.

You see, people think BTC is Bitcoin. It’s not. Just as we once referred to photocopies as Xeroxes and now a Kleenex is just facial tissue, Bitcoin means an economic paradigm in which finite scarcity of 21 million coins according to a specific emission formula occurs. It is not tied to any one underlying blockchain. Bitcoin, according to Satoshi Nakamoto, is a peer to peer electronic cash system, one that is explicitly designed for person to person operation without trusted intermediaries. One CPU, one vote is how he phrased it.

Today, BTC is worth over a trillion dollars and EPIC is under 10 million. But from a user perspective, 99% of activity is on centralized platforms such as Coinbase that routinely shut down accounts and block access to funds. It is highly censorable. People who own EPIC own the actual keys to the space on the blockchain. People who think they own BTC usually find that they really own a subordinated IOU from a financial institution for BTC, which is something different. If you don’t have the keys, they’re not really your coins. A piece of paper that says someone owes me an ounce of gold is not the same as having an ounce of gold in my hand.

I highly recommend you take 10 minutes and read the DNA of Bitcoin, to understand why something that costs $50k cannot do what something that costs 50 cents can. The 50 cent thing can also do everything the $50k thing can, so how long can this relative misvaluation persist?

If I have $1000 worth of BTC sitting at Coinbase, I always have to worry that they will restrict access to my account. Reddit has countless user horror stories of how people came to lose money because of their policies.

If I have $1000 worth of EPIC sitting on the blockchain, nobody can prevent me from accessing that value. If I have the keys, then I can transfer ownership of those coins to anyone in the world within 2 seconds, because that’s how long a transaction takes to enter the mempool. Within 60 seconds, a block cements the transaction immutably into the blockchain.

People buy Bitcoin because they believe in the scarcity paradigm of 21 million. Even though the rival camps of Bitcoin Cash, Bitcoin Core, and Bitcoin SV disagree about many things, they all agree on 21 million. EPIC does too, as it features the exact same “Bitcoin song” on a different physical disc - CD vs DVD vs BLU-RAY, if you will.

Owning EPIC protects a user’s wealth through the management of scarcity according to the principles of stock to flow. Whatever level inflation is today, you know 100% that it will be less in the future. Not only do you know that it will be less, but you know exactly how much. The monetary policy of EPIC is precisely Bitcoin, and there will be 20.4 million coins at the Singularity in June of 2028 on the way to 21 million in the year 2140. EPIC and BTC share the exact same emission curve.

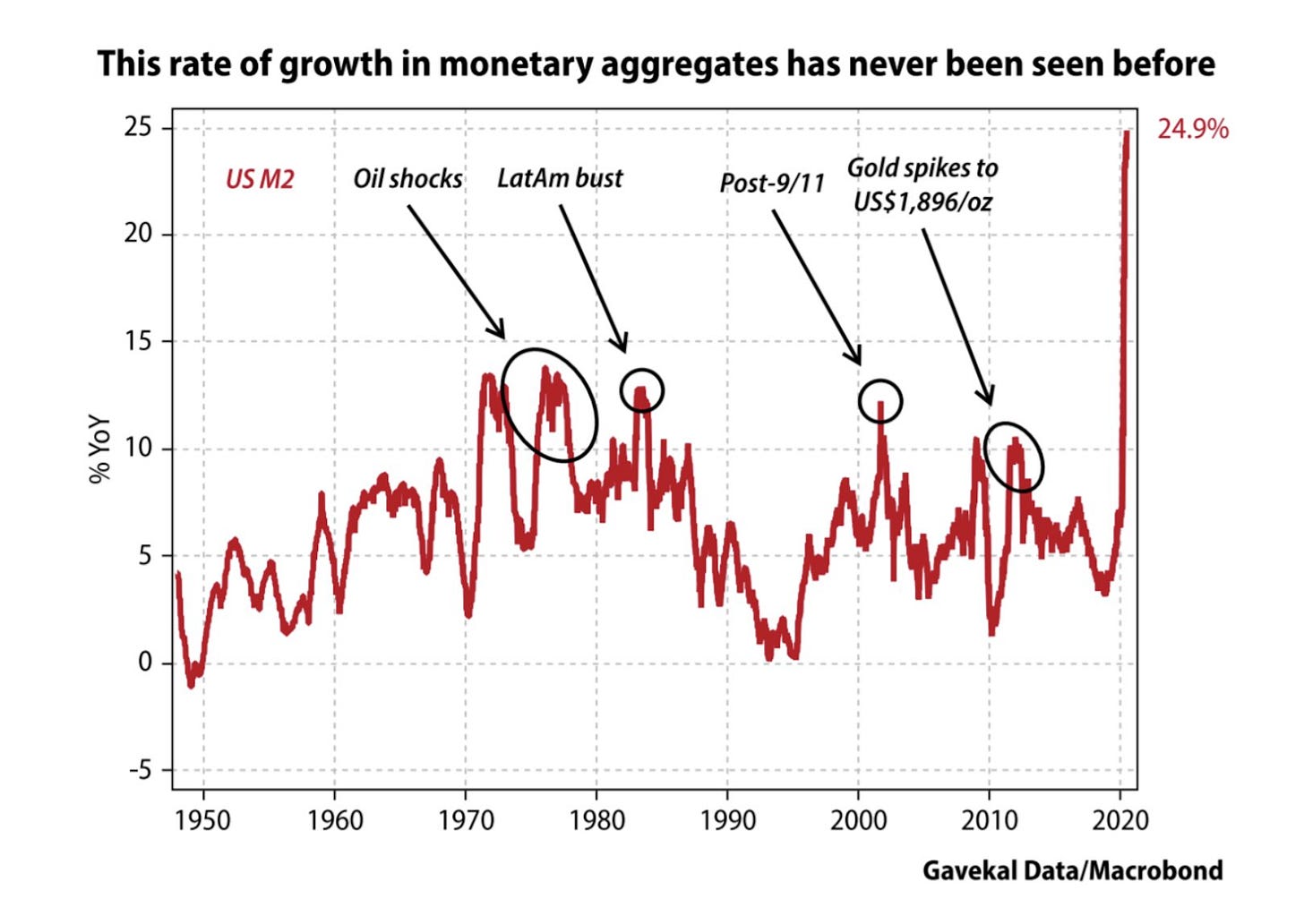

Censorship resistant provable digital scarcity on a blockchain that is open, public, permissionless, borderless, neutral and immutable is extremely valuable in a macro monetary environment in which all fiat currencies are simultaneously hyperinflating. The United States M1 money supply stood at 4.0 trillion Federal Reserve Notes as of February 2020. Today in August 2021, that number is 19.2 trillion Federal Reserve Notes.

Imagine the entirety of wealth in the world as a pizza pie, perhaps a big 16” from Papa John’s to feed the whole family. Pre-lockdown, that pie is cut into 4 slices. Now today, that same pie is cut into 19 slices. Have you been to a store lately? The product sizes get smaller and the price goes up. This is called shrinkflation and it is an optical illusion, a kind of trick that only works because the value of the currency is so rapidly eroding.

I highly recommend also reading “When Money Dies” by Adam Fergusson, which is about the Weimar Republic hyperinflation, as it is very similar to what we are seeing now. Inflation is not going to be transitory, it has just barely begun. If you had access to a money printer to create money for free, would you shut it down? Highly unlikely.

As the Cantillon Effect plays out,

things are going to get even crazier in the financial markets as the careful market balance achieved over generations as Bretton Woods in 1944

gave way to Guns and Butter in 1971 with the introduction of the coercion-based Petrodollar standard

that prevailed until very recently. What backs EPIC is the wall of encrypted energy that gets more secure every block, the most secure systems known to man. Bitcoin has never been hacked. What makes the Federal Reserve Note valuable, in the words of Paul Krugman, is, quote, "men with guns".

No guns are needed to ensure the continued operation of EPIC.

We’ve seen pestilence and plague already, no doubt next it will be conquest and war, AI fighting aliens with us humble humans caught in the crossfire as this real-time immersive role play experience occurring all around us plays out. The mighty Wurlitzer

Frank Wisner

The mighty Wurlitzer is alive and well and I for one am surely having trouble making sense of the world today. When you can’t believe anything anymore, you know what you can believe in? That 0+1=1, and it always will.

Epic is based on simple math. Inputs equals outputs, that’s all. The math is open source, the code is open source, it will never change. There will never be more than 21 million EPIC.

That’s it! One simple equation is Mimblewimble in a nutshell.

These technologies are not going away. The software that works today will continue to work tomorrow, as it has for over 1 million blocks so far, once a minute like clockwork.

Despite attempts to restrict it, the history of the technology industry shows us that progress continues apace regardless. It used to be said that the only things certain in life are death and taxes.

Today, whatever else may be uncertain, what is certain is that EPIC will endure. More complicated approaches to privacy such as those used by Zcash and Monero are not better than Mimblewimble, they are just more complicated.

Complicated software has more bugs than simple software. Unequivocally, EPIC anonymity and privacy are second to none. Its clean, simple design is an excellent foundation on which to build while others struggle with technical debt.

Whatever else may be constructed upon it later, EPIC has enduring intrinsic value because of its utility as a reliable tool of trade at a distance. Its market price derives from the value that performance as a tool provides, one that provides a service of confidential immutable fungible instant transactions. EPIC allows for payment of anyone, anywhere, anytime, any amount, for any reason, and nobody can stop you.

BTC is merely a tool for speculation at this point since it is censorable and prohibitively expensive to use.

With the EPIC++ paper coming out soon, I can share that we have identified a very achievable path to attain a capacity level on the order of Visa - approximately 100 million per day - this is not enough to handle the whole world’s needs quite yet but it’s a strong start. We aim to increase our Layer 1 transaction capacity by 64 times or 6400%, from 17 to 1000 transactions per second.

With so much to be fearful about, my purpose in writing this is to provide reasons for hope. Hope that the future will be better than today. That we have things to look forward to, not to dread.

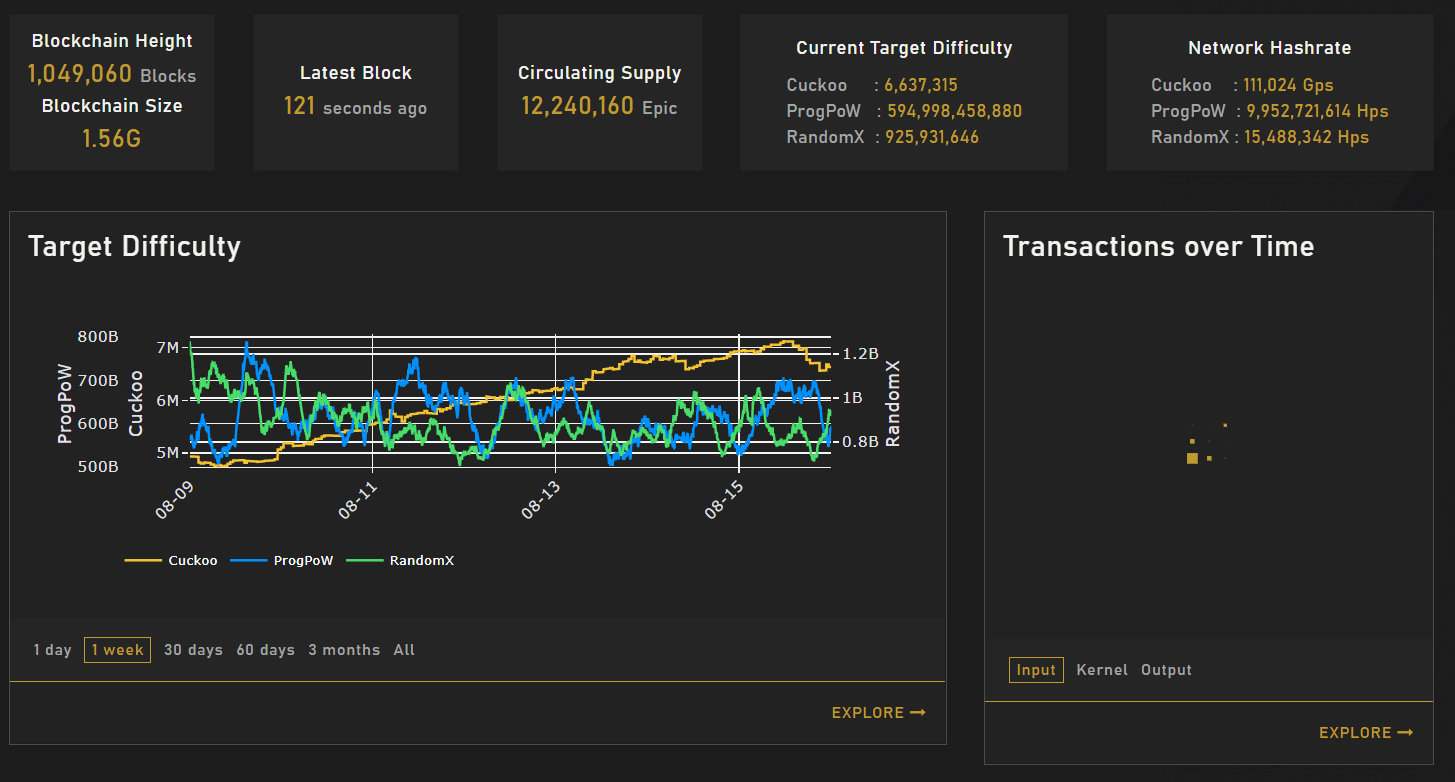

EPIC will never be more difficult to buy than it is today. It will never be less widely known. Its usage is growing, not shrinking. The network exists in 101 countries, 512 regions,

with most of those thousands of nodes contributing to security via mining. We are on track to overtake Monero in terms of number of nodes. Because Monero’s chain is 100GB and ours is 1.5GB

and you can’t mine Monero on a GPU, but you can mine EPIC, we are picking up market share. Despite no paid marketing in a sea of 10,000 coins clamoring for attention, we continue to steadily grow.

We will never have fewer wallet options, and the future wallets will be better, not worse. We have lined up strong partners, a few announced already and many more to follow, to connect EPIC to all other blockchains to create a universal fungibility layer for the entire cryptocurrency industry.

The cryptocurrency industry has problems and quite simply, we have the answers. Fungibility, tainted coins, regulatory compatibility, MEV, environmental footprint, future-proofing, multi-chain and multi-asset.

Composable, interoperable, trustless, permissionless, borderless, neutral financial primitives enable unparalleled innovation to be built atop the protocol because of lower barriers to entry.

It’s still very early days. In BTC terms, we are in 2011. If you’re not already following the Freeman Family story, how we’re working on building Epicenter, please join us at t.me/epiccash.

The tree of liberty must be watered from time to time with the tears of banksters and crony capitalists.

Generations ago, Andrew Jackson unshackled the American people from its predatory parasite infestation of the era, the predecessor to today’s privately owned offshore banking monopoly, the Federal Reserve cartel.

Back in 1833, it took electing a President to change the monetary paradigm and restore prosperity through sound money, which is the basis of a sustainable society.

Today, we don’t need to get any politicians involved to declare our own emancipation from the bondage into which we were born. All it takes is to reclaim our individual sovereignty by arming ourselves with the latest tools in financial self defense.

It’s time to break the chains and together we can do it.

Stay strong, Freemen!

Monday, August 16, 2021.

Once people get serious beyond just "numbah go up", fungibility is not optional scalability is not optional, security is not optional. BTC was great but its simply not a solution as digital cash and a store of value. Great post Max! #epicismoney #freemarkets

i swear you are best jokes i have ever seen